Table of Contents

Biden Wipes Out $9 Billion in Student Loan Debt

The Biden administration recently disclosed plans to erase a total of $9 billion in student loan debt, easing the burden of debt for an additional 125,000 students.

These borrowers had previously been qualified for debt relief through a number of programs, such as the Public Service Loan Forgiveness program for teachers and healthcare workers, income-driven repayment plans that tied payments to income and offered forgiveness after 20 or 25 years of payments, as well as discharges for people with disabilities.

These fortunate individuals, who had long awaited respite from their student loan obligations, received the coveted ‘golden emails’ notifying them of this monumental relief. The White House has outlined the distribution of the $9 billion debt forgiveness as follows:

Approximately $5.2 billion will be allocated to 53,000 borrowers who dedicated at least a decade to careers in eligible public service sectors such as education and the military.Nearly $2.8 billion is earmarked for nearly 51,000 borrowers through adjustments to income-driven repayment plans.

These individuals diligently made payments for two decades or more, finally reaching the threshold for debt forgiveness.

An additional $1.2 billion is set aside for nearly 22,000 borrowers who have permanent disabilities, identified through a social security data match.

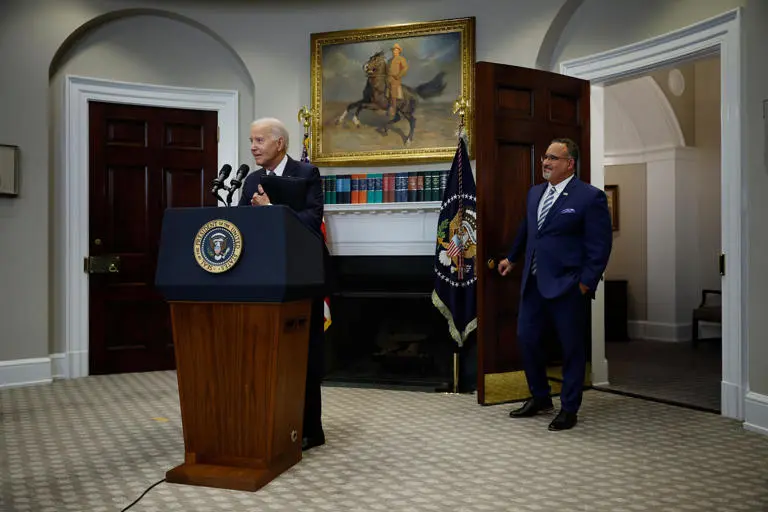

These actions by the administration, described by Education Secretary Miguel Cardona as “efforts to rectify the flawed student loan system,” coincide with the resumption of student loan payments for millions of borrowers after an unprecedented three-year hiatus during the pandemic. Some of these fortunate borrowers have only recently met the criteria for loan forgiveness, while others, due to bureaucratic complications or other obstacles, have long been denied the relief they were rightfully entitled to.

This latest announcement comes on the heels of several similar actions taken since June when the Supreme Court invalidated President Joe Biden’s initial plan to provide up to $20,000 in loan forgiveness for most borrowers. While the president’s ambitions for widespread relief were thwarted, his administration has succeeded in chipping away at student loan debt on a smaller scale.

The pause in student loan payments has now concluded, prompting borrowers to prepare for their repayment obligations. Among the 125,000 beneficiaries of the recent announcement are individuals who, like their counterparts, enrolled in income-driven repayment plans, diligently repaid their loans for over two decades, and are now poised to have their outstanding balances forgiven.

Furthermore, other groups promised loan forgiveness include borrowers who were deceived or defrauded by their educational institutions or attended schools that abruptly ceased operations. In the grand scheme, over 40 million Americans currently grapple with student loan debt, amounting to a staggering $1.7 trillion.

Looking ahead, the Biden administration is gearing up for a second attempt at widespread loan forgiveness. In the upcoming week, a committee comprising representatives from colleges, borrowers, state attorneys general, and student loan servicers will convene for the first time to explore alternative avenues for reducing student loan burdens on a larger scale.

This committee, utilizing a process known as negotiated rulemaking, will convene multiple times over several months. Any proposals they develop will likely require considerable time to materialize and could potentially be reversed by a future administration.

In the interim, President Biden is urging borrowers to consider enrolling in his newly launched income-driven repayment plan, also known as Saving on a Valuable Education (SAVE). Under this program, borrowers with incomes below a specified threshold, determined by family size, may see their payments reduced to $0. Borrowers already enrolled in another income-based option, Revised Pay As You Earn (REPAYE), have been automatically included, while others will need to apply to benefit from this initiative.